Does Share Repurchase Always Generate Value for Continuing Shareholders

Do Stock Buybacks Create Value or Just Return Capital to Investors?

Members at companies with excess cash discuss whether share repurchases generate economic value for shareholders.

ConocoPhillips on Wednesday announced it is resuming its share repurchase program, citing its "long-standing priority to return greater than 30% of cash from operations to shareholders annually." The company is not alone:

- A recent NeuGroup Peer Research Survey showed that 82% of respondents consider the return of excess capital the primary objective of their company's share repurchase program. Only 9% said creating shareholder value was the primary goal.

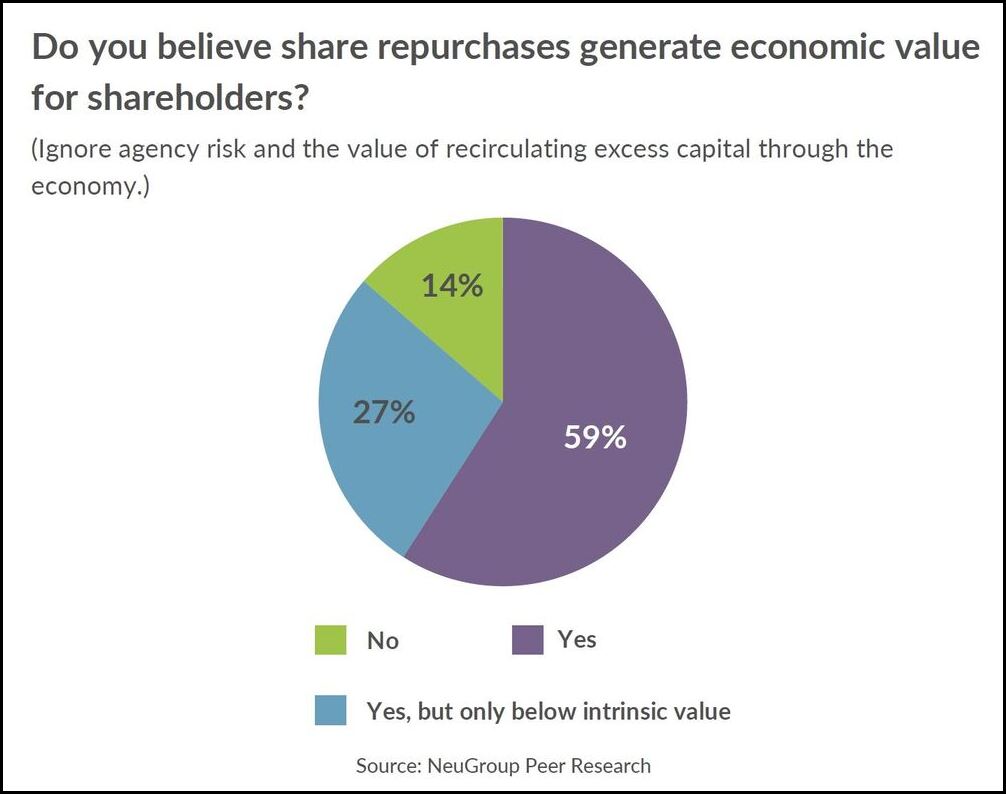

- However, 59% of respondents said they believe share repurchases generate economic value for shareholders (see chart) and another 27% agreed—but only if the share purchase price is below the company's intrinsic value.

Surprising result? The NeuGroup member who requested the survey expressed surprise at the number of his peers who believe buybacks generate economic value.

- He told the group that when his company asks banks do analyses of its total shareholder return (TSR), "They ascribe zero value to repurchases and dividends. Their rationale is that this is capital that the shareholders have a claim on regardless of whether it's in the company or in their pocket."

- "My view is that repurchases might create value if they are below intrinsic value, but as people said, intrinsic value can be tough to define," he said in a follow-up email. "And the reality is that a company's shares probably don't trade below it very often anyway."

- In his follow-up, he also cited a white paper that he wrote: "There is no certainty that any gap between intrinsic and market value will ultimately close; additionally, a study by Fortuna Advisors, a strategic advisory firm, indicates that 'over time the market sees through this engineered EPS growth and typically drives down the P/E multiple for companies that rely heavily on buybacks.'"

- The white paper also says, "There is evidence to suggest that newly announced repurchase authorizations cause at least temporary share price bumps, but this is due to the signaling effect (of companies indicating they are bullish on their future), not repurchases themselves."

In the yes camp. One of the members who believe share repurchases create value for investors if the price is below intrinsic value said his company "beats VWAP (volume weighted average price) more than we don't." He explained his strategy for executing buybacks and emphasized the goal is not to be a day trader but to "buy back as many shares as I possibly can" using the amount allocated for buybacks by the board.

- Another member in the yes camp explained some of his reasoning in a follow-up email, writing, "Part of adding shareholder value is minimizing agency costs (arising from a lot of things but fundamentally to misaligned incentives and interests between management and shareholders).

- "So distributing excess cash is a way to reduce this, with the idea that when you get rid of excess cash by buybacks, in addition to a neutral cash distribution, you're minimizing agency costs."

Not convinced. The treasurer who requested the survey said the discussion at the meeting did not prove to him that repurchases generate economic value.

- "The arguments mostly seemed to circle back to whether repurchases are beating VWAP, which in itself does not indicate they're creating economic value," he said.

- That said, he does agree that the "avoidance of agency costs, i.e., the risk of making bad investments just because the cash is available" is one of the valid reasons to do a buyback.

Other reasons to do buybacks. This treasurer's other main reasons to do repurchases include moving "inefficient capital off the balance sheet. Excess cash is inefficient capital; bank deposits, money market funds, etc. earn well below WACC (weighted average cost of capital)."

- His white paper offers another reason to buy back stock: "Investors frequently redeploy the proceeds of stock sales to other investments in the economy, essentially shifting capital from companies that have more than they need to companies that need capital to grow.

- "This cycling of capital is healthy for the economy. According to Lloyd Blankfein, former CEO of Goldman Sachs, the proceeds investors receive from selling shares get 'reinvested in higher growth businesses that boost the economy and jobs.'"

Source: https://www.neugroup.com/do-stock-buybacks-create-value-or-just-return-capital-to-investors/

0 Response to "Does Share Repurchase Always Generate Value for Continuing Shareholders"

Post a Comment